Here’s a look at how much solar panel systems cost on average for most states, according to data from FindEnergy.com. These costs can range from 10% to 20% of initial development costs annually. Pricing strategies can range from free with in-app purchases to premium pricing models. This depends on factors such as marketing effectiveness, user acquisition rate, and monetization strategy.

What is a variable cost?

Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. Ready to find out how many units you need to sell to cover your costs? The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time.

Formula 2: BEP (Sales Dollars)

Only after surpassing this number will they begin to generate a profit. If you’re more interested in the number of units you need to sell, use Formula 1. However, if your focus lies on the total sales revenue required, Formula 2 comes into play.

Is your sales price right?

The total variable costs will therefore be equal to the variable cost per unit of $10.00 multiplied by the number of units sold. In terms of its cost structure, the company has fixed costs (i.e., constant regardless of production volume) that amounts to $50k per year. Recall, fixed costs are independent of the sales volume for the given period, and include costs such as the monthly rent, the base employee salaries, and insurance. Having high fixed costs puts a lot of pressure on a business to make up those expenses with sales revenue. If you find yourself falling short of your break-even point month over month and feel like you can’t change your prices, lowering your fixed costs can be a solution.

Let’s take a look at a few of them as well as an example of how to calculate break-even point. When you know exactly how many units you need to sell to reach the break even point, it becomes easier to plan ahead of the time. So, your break even plan will form your datum point at which you become profitable. Achieving 5% may well be the disired growth rate to allow the business to succeed, achieving 10% or 20% would facilitate excellent business growth. Knowing this allows you to set targets for your sales teams and provide incentives for them (financial, promotion, shares etc.).

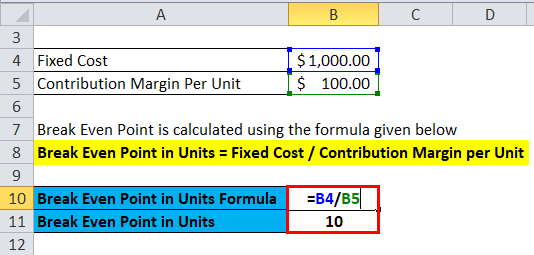

When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales capital employed formula calculation and examples dollars. The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured.

- Whether using Excel, online calculators, or accounting software, these tools simplify the break-even analysis process and provide valuable insights that guide pricing, budgeting, and growth strategies.

- These costs can range from 10% to 20% of initial development costs annually.

- For instance, what happens if raw material costs rise or if the company is forced to lower its selling price to stay competitive?

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- Break-even analysis is a crucial tool for businesses of all sizes, as it helps in understanding the relationship between costs, sales, and profits.

- With a background in higher education and a personal interest in crypto investing, she specializes in breaking down complex concepts into easy-to-understand information for new crypto investors.

Break-even analysis involves a calculation of the break-even point (BEP). The break-even point formula divides the total fixed production costs by the price per individual unit less the variable cost per unit. For example, if a business increases its prices, the BEP will shift, potentially allowing profitability with fewer units sold. Conversely, if costs rise, the company will need to sell more units to break even. The break-even point (BEP) is the point at which total revenues equal total costs. At this stage, a business neither makes a profit nor suffers a loss.

When you decide to go solar, you are either committing to a significant upfront cost of tens of thousands of dollars or a long-term plan through several years of monthly payments. The breakeven point, or payback period, is the time it takes to recoup the cost from the initial investment. The contribution margin is the difference between revenue per download and variable costs per download. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure. Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly.